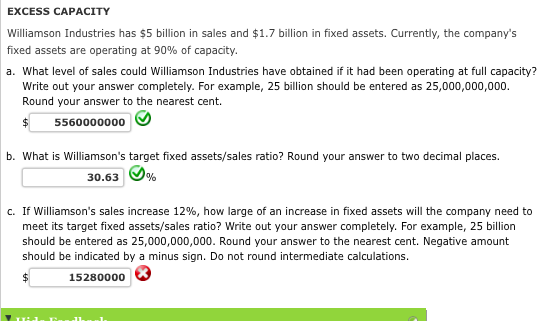

What is the nursery's full capacity level of sales? The Cardinals are hoping for full capacity at Busch Stadium by June The vice president of ticket sales told radio station KMOX that team officials are 1 Answer to Ed's Market is operating at full capacity with a sales level of $547,0 and fixed assets of $471,000 The profit margin is 54 percent What is the required addition to fixed assets if sales are to increase by 4 percent?

Thedocs Worldbank Org En Doc Render Worldbankgrouparchivesfolder Pdf

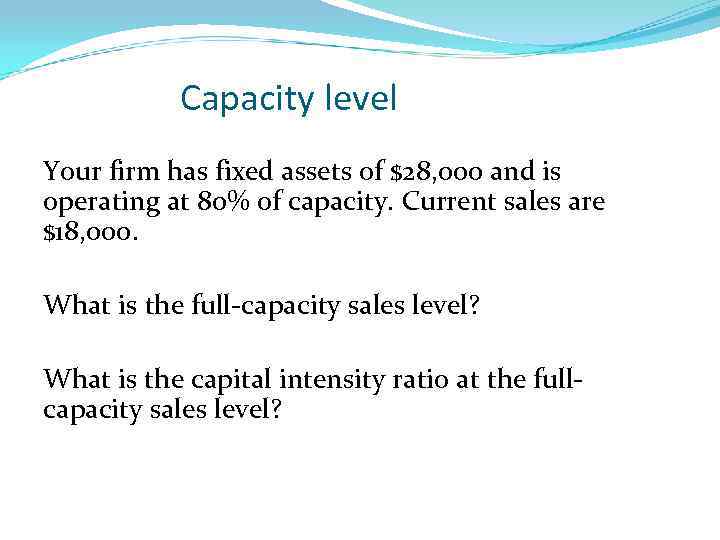

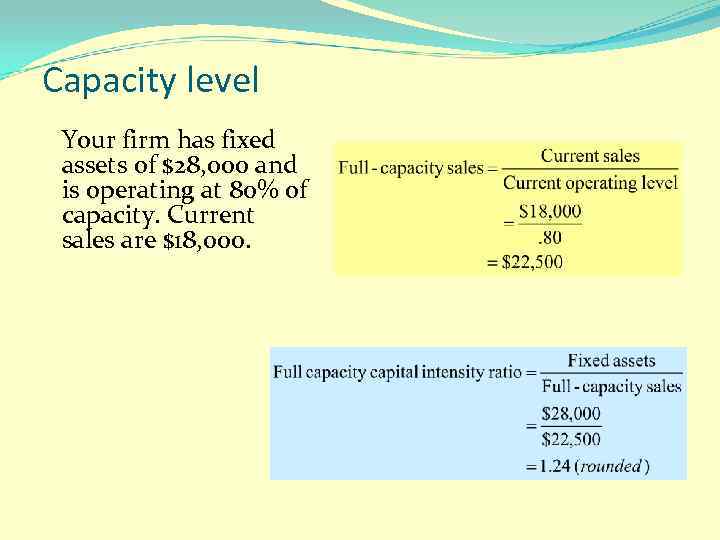

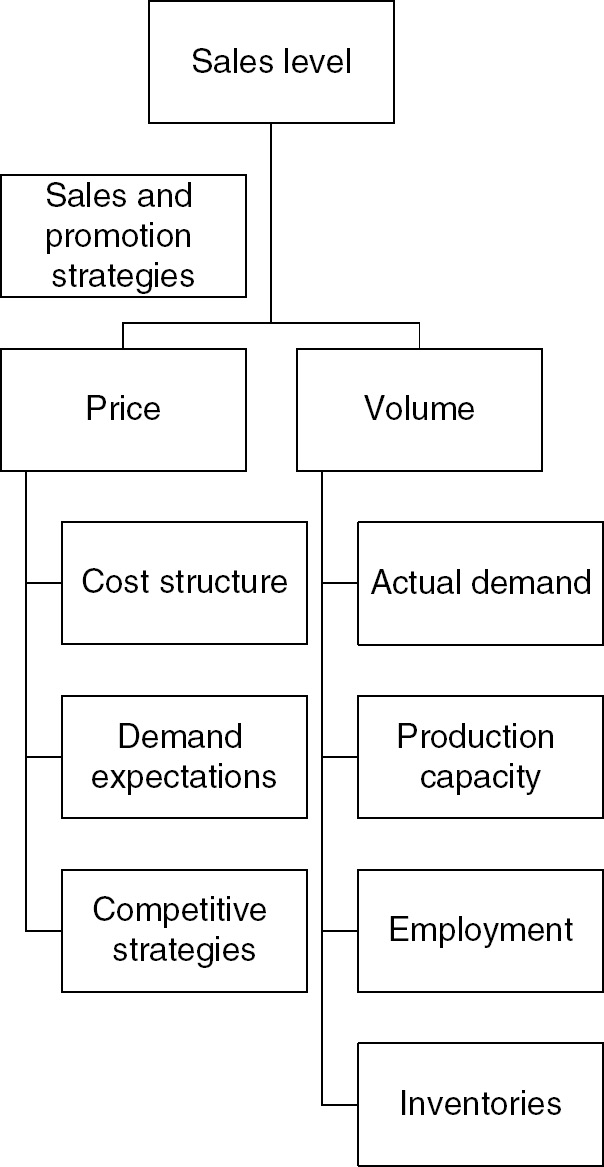

How to calculate full capacity level of sales

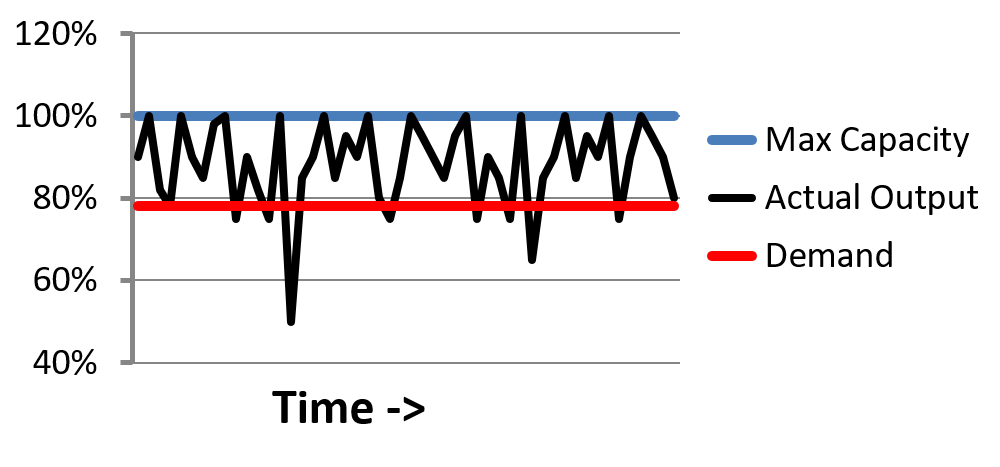

How to calculate full capacity level of sales- In one company, for example, the sales team sets the schedule and sells time slots of the bottleneck to make sure that the demand line never crosses the maximum capacity line The ontime delivery of this company has stayed close to It rates the capability of an organisation to manage specific processes from 15, so that was the starting point for my Sales Capability Model Level 1 – Unstructured Processes undocumented

Covid 19 Is A Persistent Reallocation Shock Bfi

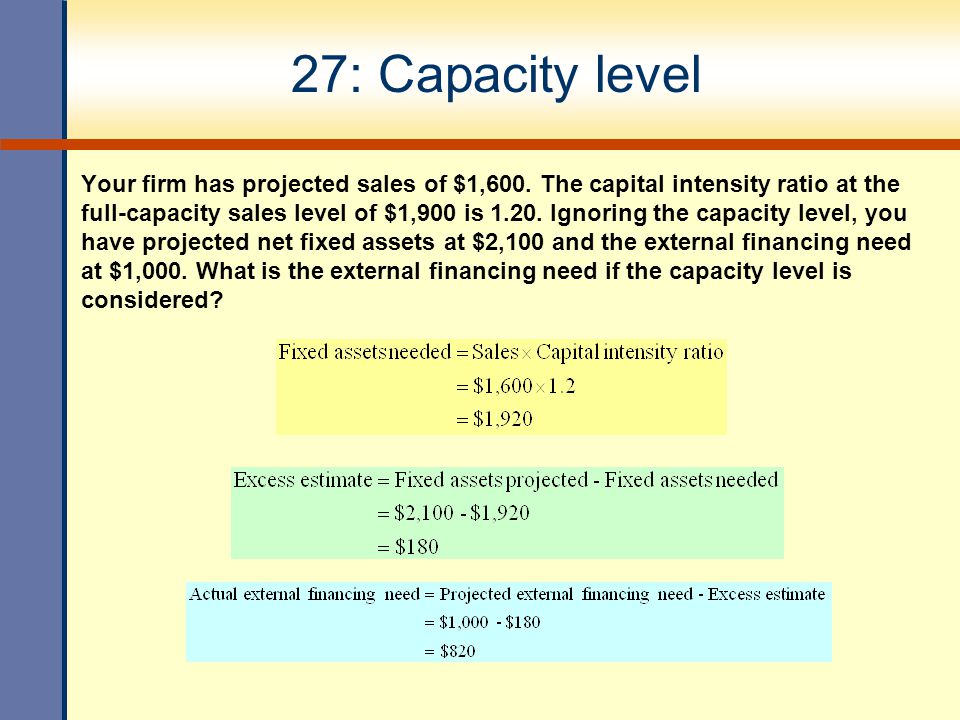

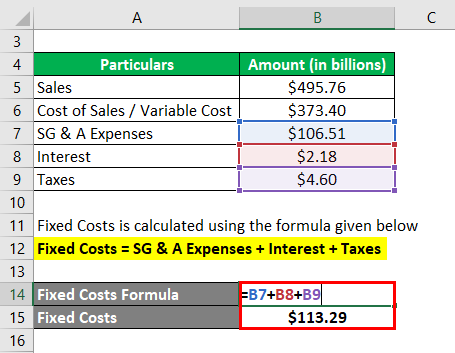

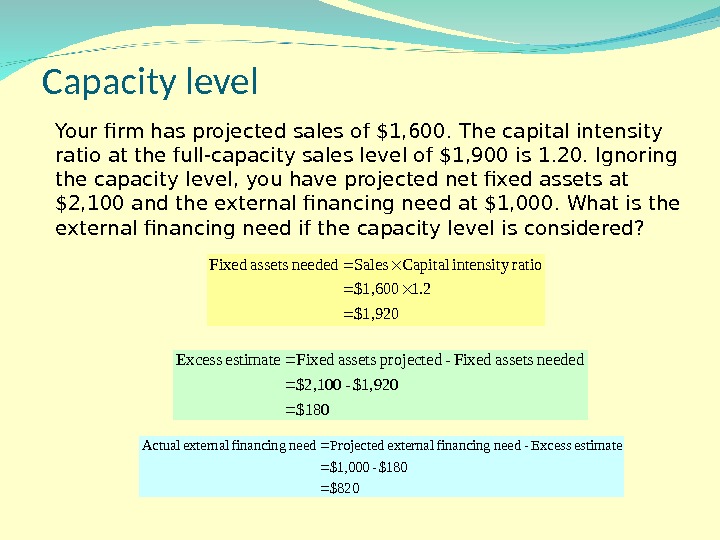

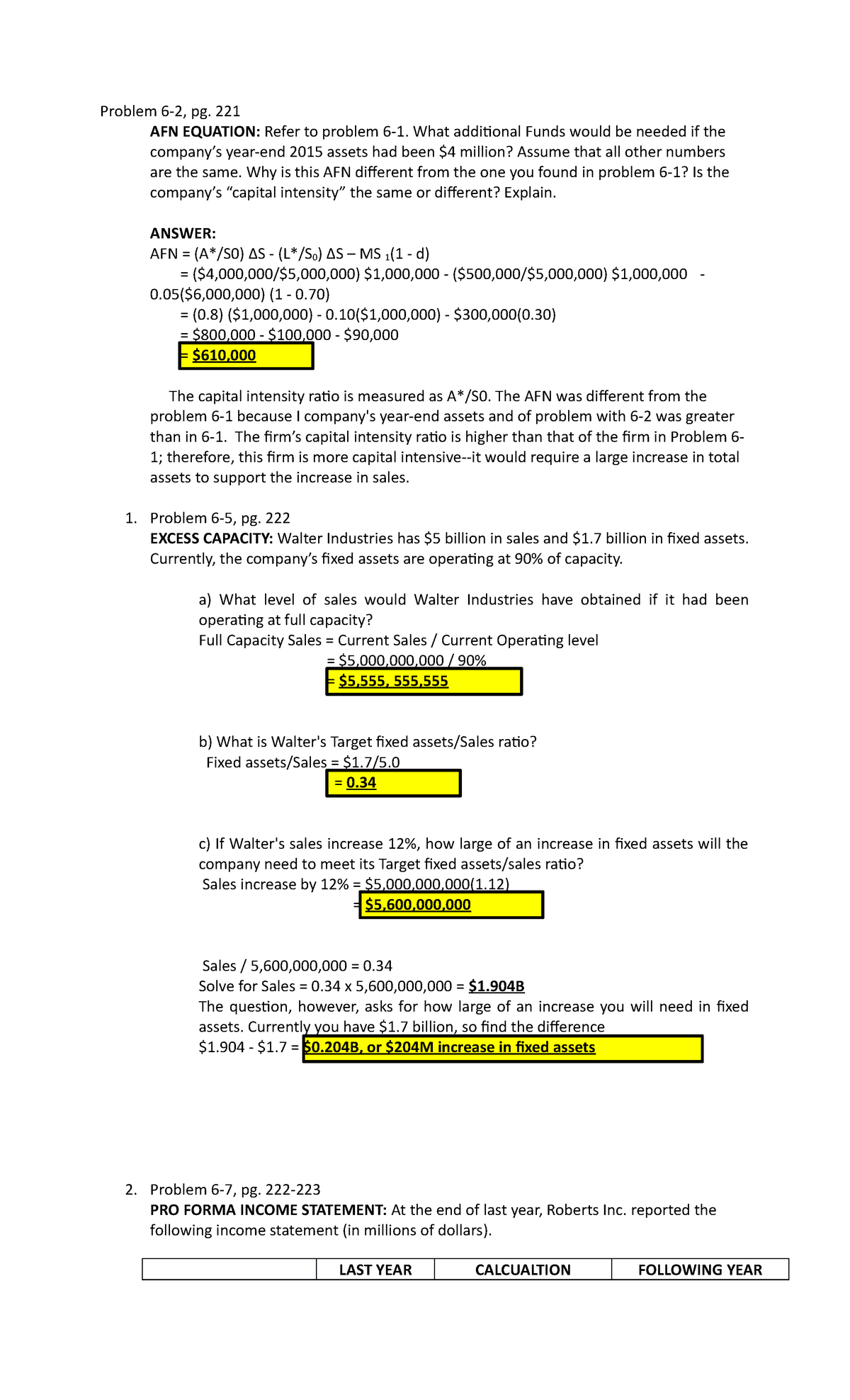

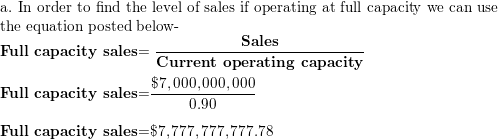

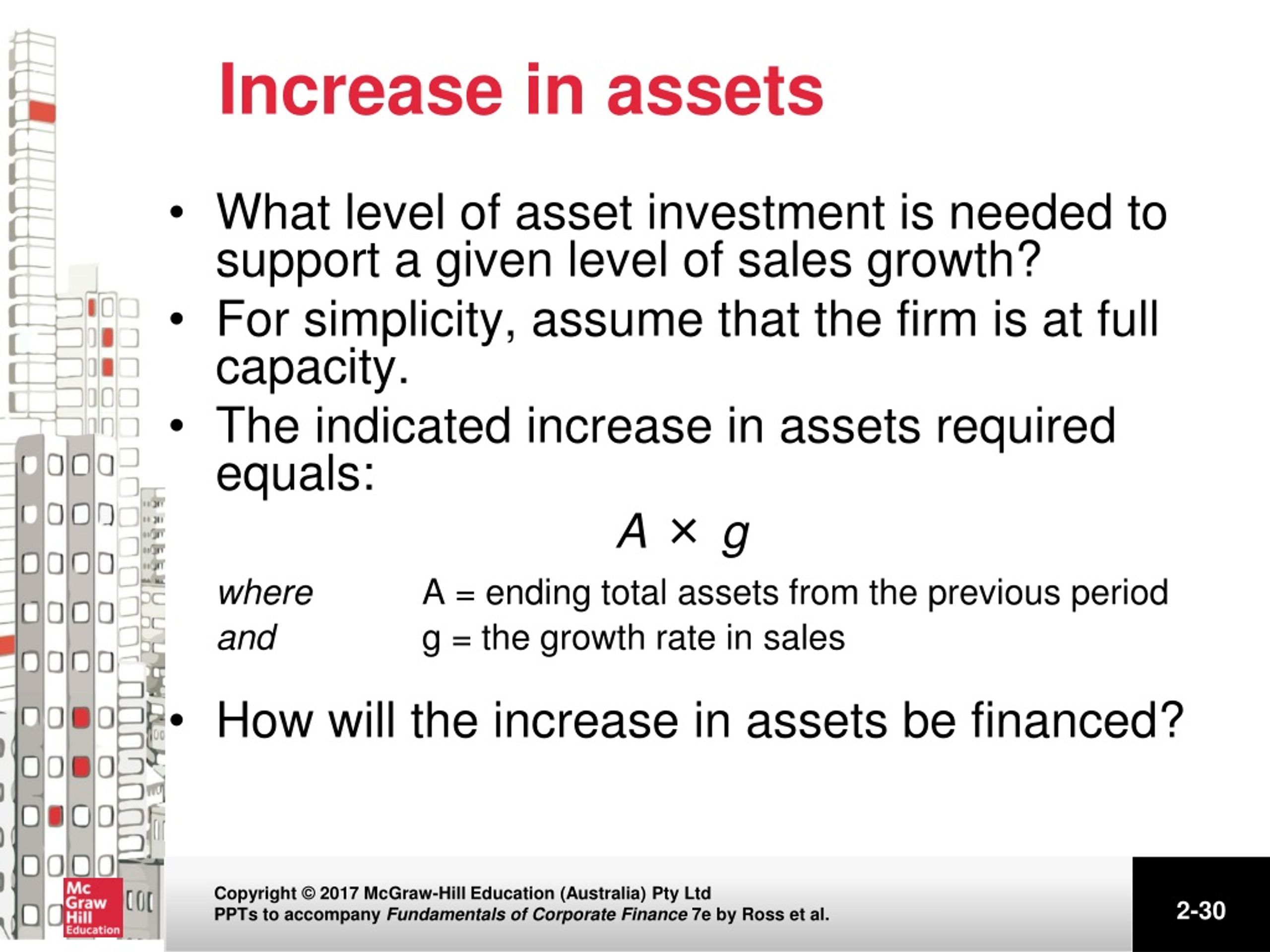

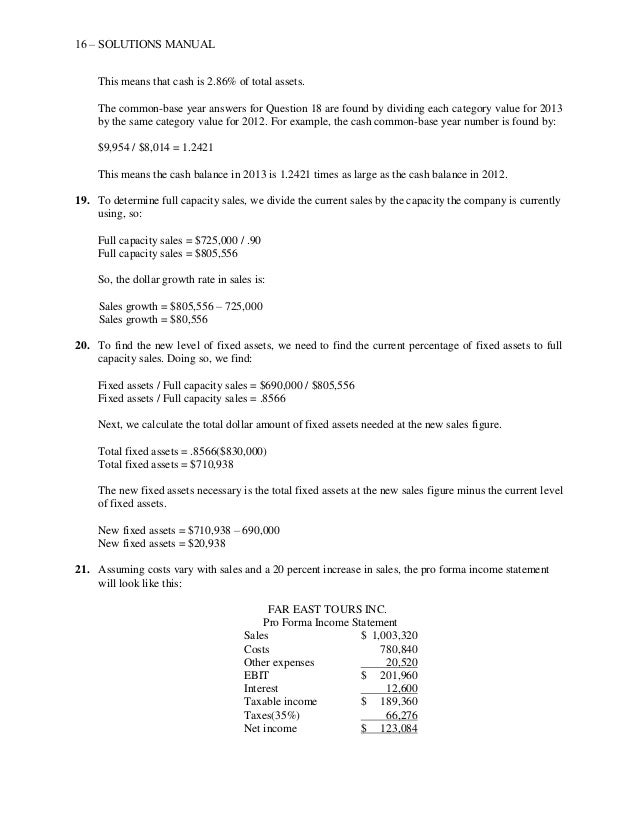

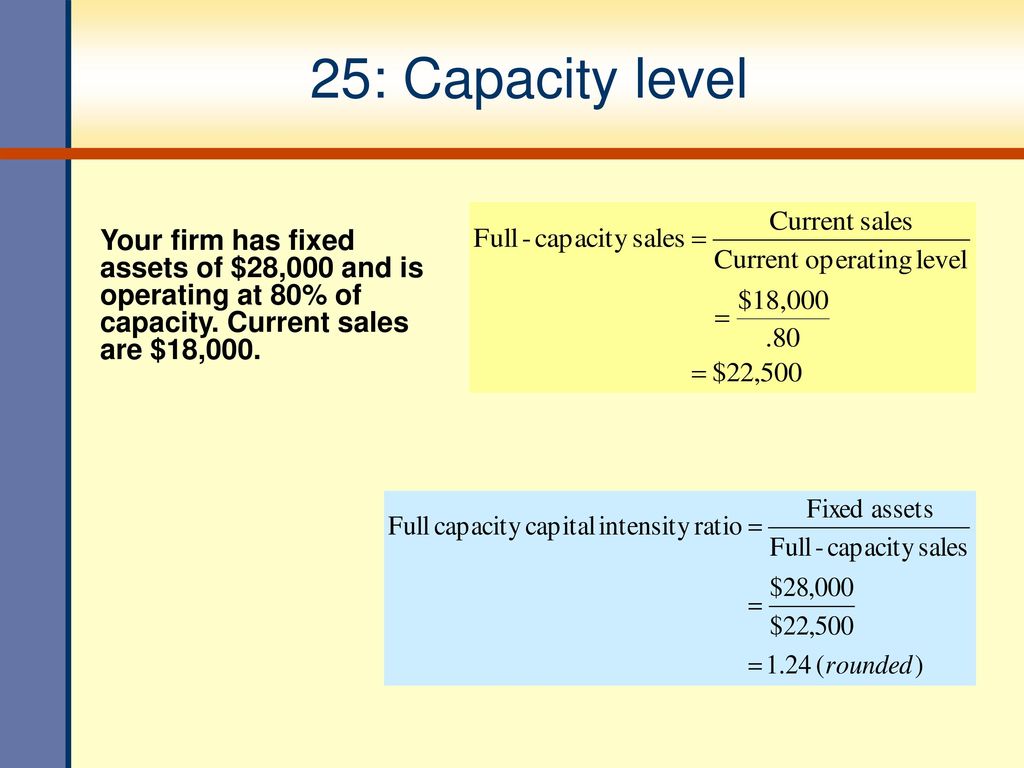

Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management toFull Bio Follow Linkedin Follow Capacity refers to the maximum level of output that a company can sustain If a company dramatically increases its sales and needs to increase itsCapital intensity ratio = $6,910 / $7,250 = 95 9 a Increase in retained earnings = ($900 – $630) ( (1 13) = $ 10 c Fullcapacity sales = $5,800 / 75 = $7,;

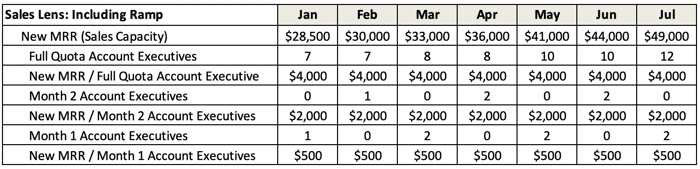

At its simplest, the formula for traditional Sales Capacity Planning = SR * H * W * CR * ST As an example, a sales team with seven reps, working 45 weeks per year, with a 30% closing rate and a 40% selling time, the formula would be Sales Capacity = SR (7) * H (40) * W (45 weeks / year) * CR (28%) * ST (40%) This results in a total sales capacity of 1081 sales/year for the team The assumption is that each team member makes 215 average salesWhat is the fullcapacity level of sales?Again, this is a job for Tuning Your Revenue Engine as it will show you your current operational capacity so you can set the right sales goal to maximize your The Difference Between Operations and Strategy ceriusexecutives at 705 pm Reply

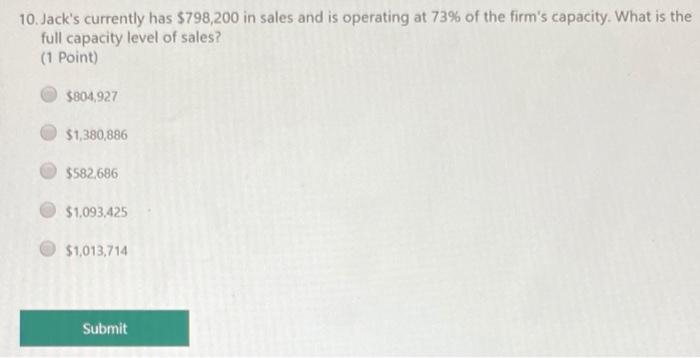

8 b Fullcapacity sales = $5,800 / 80 = $7,250;The current sales is only at 86% thus, to get the 100 percent (FULL) capacity level of sales, the current sales will be divided with the current operating percentage 4) Rural Markets has RM878,000 of sales and RM913,000 of total assets The firm is operating at 93 percent of capacity The exact amount of capacity to maintain can be planned for using capacity requirements planning, which calculates required capacity levels at different sales levels and product mixes It is possible to largely eliminate capacity costs by shifting work to third parties

Business Process Framework Tm Forum

Excess Capacity Williamson Industries Has 5 Bilion Chegg Com

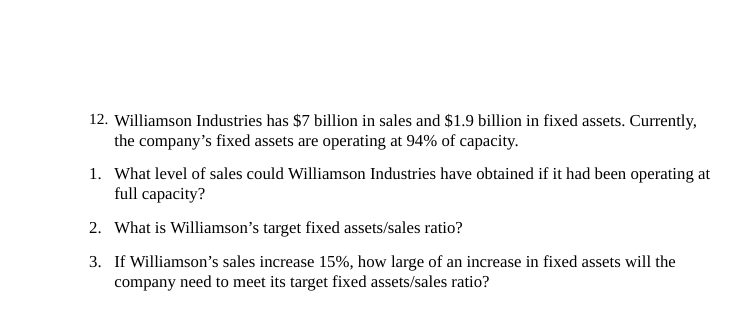

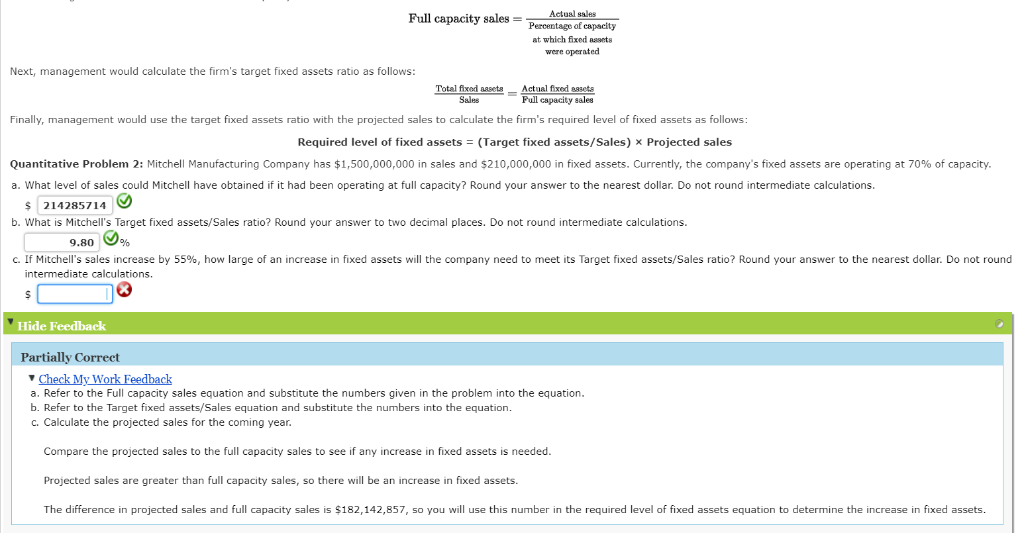

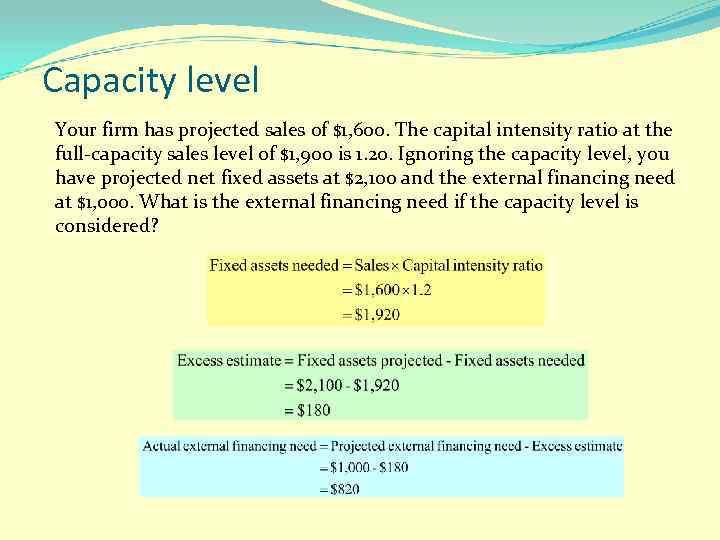

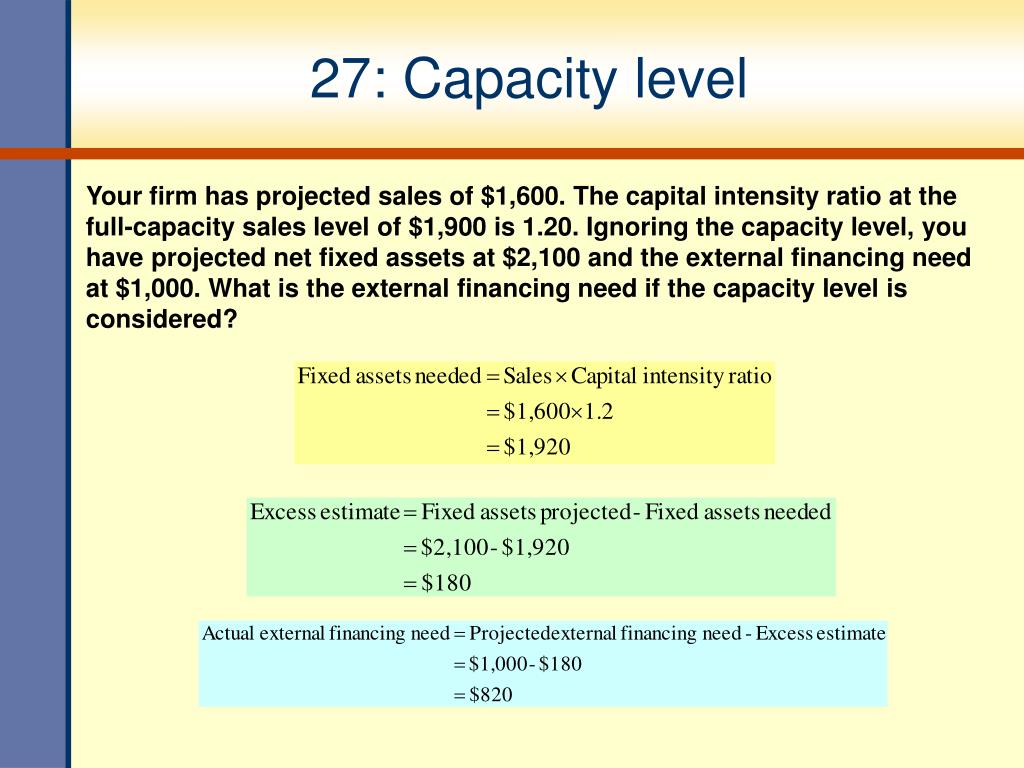

Enter your answer in millionsFull capacity sales = Actual sales Percentage of capacity at which fixed Assets were operated Next, management would calculate the firm's target fixed assets ratio as follows Total fixed as Sales Actual fixed assets Pull capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level of fixed assets as follows Required level of fixed assets = (Target fixed assets/Sales) * Projected salesFirst, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assets required at full capacity sales is the capital intensity

Building Your First Sales Capacity Pipeline Requirement Plan By Around The Bonfire Medium

Consumer Electronics Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Retail News Et Retail

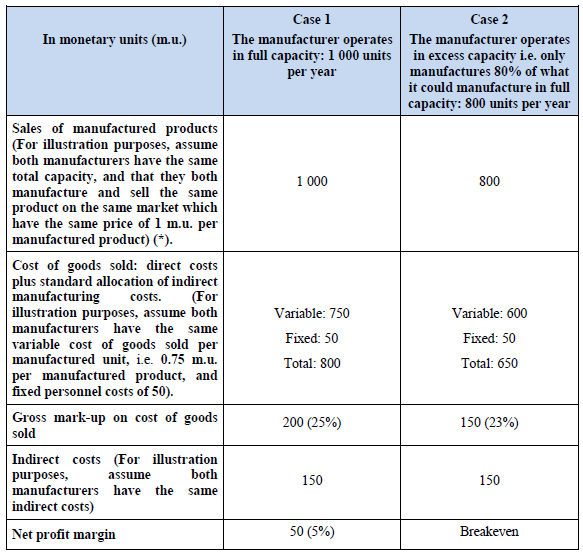

Wagner Industrial Motors, which is currently operating at full capacity, has sales of $29,000, current assets of $1,600, current liabilities of $1,0, net fixed assets of $27,500, and a 5 percent profit margin The firm has no longterm debt and does not plan on acquiring any The firm does not pay any dividendsAssignment detail View Answer Reference no EM Question – An enterprise has excess capacity in productionrelated property, plant, and equipment If in a given year these assets are being used to only 80% of capacity and the sales level in that year is 2 million, calculate the full capacity sales level?The fullcapacity sales of Beige Inc is $12,000 million, whereas the existing sales level is $9,000 million What is the percent of capacity used to generate the existing sales level?

How To Do Annual Sales Capacity Planning Blogs

Exam 1 With Answers On Intermediate Financial Management Fin 470 Docsity

The Sales Productive Capacity Calculator helps sales and sales operations leaders take a datadriven approach to understanding and measuring the productive capacity of their sales teams and identify levers they can apply to improve sales capacity The tool allows users to model the sales productive capacity of a sales role in a future periodSambalpur (Odisha) India, Aug 14 (ANI) The authorities on Wednesday released the first flood water of the season from Hirakud Dam as the water level in the reservoir inched close to its full capacity Godrej Appliances has almost reached its preCOVID sales level this month, and it expects to attain full manufacturing capacity utilisation by end of September this year, said a top company official

M3 Activity 1 Pdf Retained Earnings Dividend

Tutorial

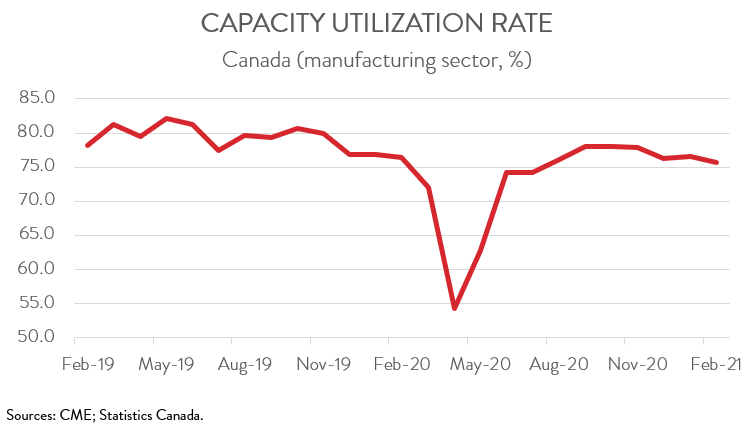

Capacity Utilization = 50% If all the resources are utilized, then the capacity rate is 100%, and this indicates full capacity It is unlikely that a company achieves 100% rate every time as it can face several hurdles in the production process 85% capacity utilization is considered good for most companiesThe full capacity level of sales is given by = 100%⋅ Current sales Current operating capacity percentage = 100%⋅ $21,900 45% ≈ $48, = 100 % ⋅ Current sales Current6 Masterbudget capacity utilization is the level of capacity that managers expect for the current time period, frequently one year 7 Theoretical and practical capacity measure capacity in terms of what a plant can supply Normal capacity and master budget utilization measure capacity in terms of demand 8

Chapter 14 Managing Demand And Capacity

What Is Sales Capacity Planning

Fullcapacity sales = $611,000/094 = $650,000 Maximum growth without additional assets = ($650,000/$611,000) 1 = 638 percent Stop and Go has a 45 percent profit margin and a 15 percent dividend payout ratio Martin Aerospace is currently operating at full capacity based on its current level of assets Sales are expected to increase by 45 percent next year, which is the firm's internal rate of growth Net working capital and operating costs are expected to increase directly with sales The interest expense will remain constant at its current level Addressing a virtual press meet on Friday, Nandi said the plants of Godrej Appliances are currently operating at 60% as compared to % in May "We will reach 80% capacity in July and full capacity from August," said Nandi Godrej Appliances said sales in May were at 3540% of last year, while in June it is already at last year level

Get Answer Break Even Sales Under Present And Proposed Conditions Battonkill Transtutors

The Constant Battle Between Sales And Manufacturing Demand Vs Capacity Industryweek

Percentage increase in sales = $7, – $5,800 / Normal capacity takes into account the downtime associated with periodic maintenance activities, crewing problems, and so forth When budgeting for the amount of production that can be attained, normal capacity should be used, rather than the theoretical capacity level, since the probability of attaining normal capacity is quite high The Hence, for a system working at full capacity, it is the average quantity produced in a given time period If your system is working at less than capacity, however, you cannot take the total production quantity For example, if you produced ,000 gizmos per week, but half of the time your people were idling, then you cannot use the ,000

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

Sales Capacity Kellblog

17 Assume the firm has a constant dividend payout ratio and a projected sales increase ofHowever, its fixed assets were used at only 75% of capacity Now the company is developing its financial forecast for the coming year As part of that process, the company wants to set its target Fixed Assets/Sales ratio at the level it would have had had it been operating at full capacityCAPACITY DETERMINATION The following is the COST ACCOUNTING STANDARD 2 (CAS 2) issued by the utilization is to be recorded and furnished in order to assess the operating level 2 Production based on sales expectancy in past 5 years = 301, 269, 297, 244 and 302 lakh units

Tpg17 Chapter Ii Annex I Paragraph 4 Tpguidelines Com

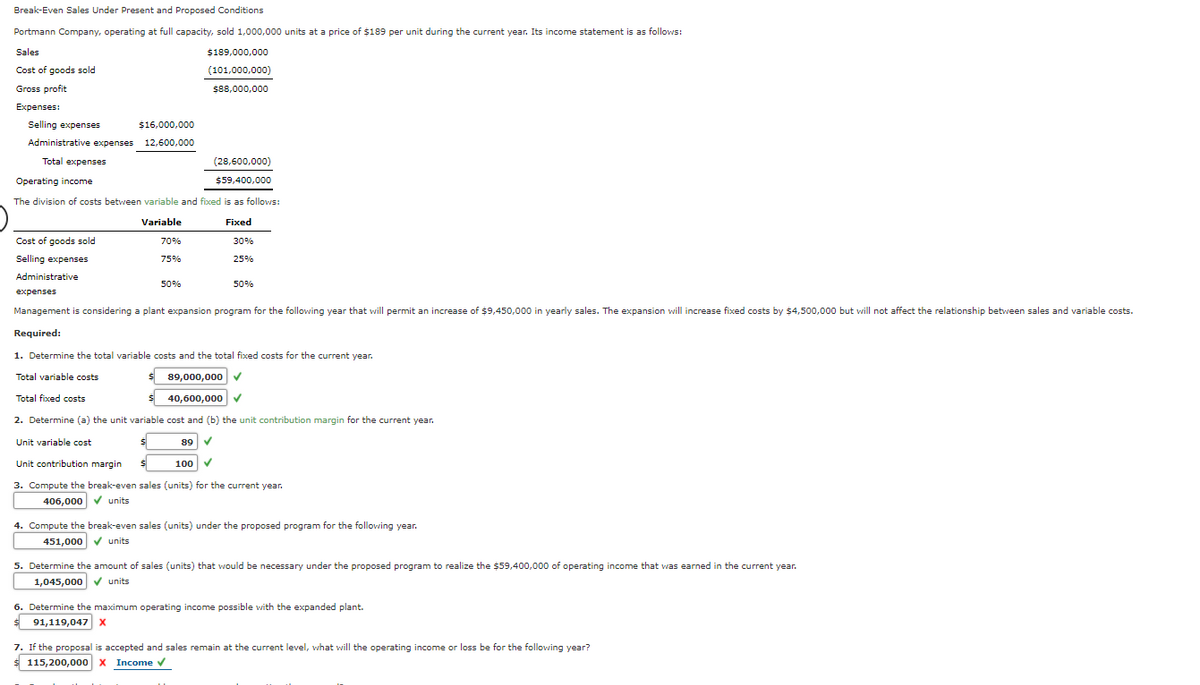

Break Even Sales Under Present And Proposed Conditions Portmann Company Operating At Full Capacity Sold 1 000 000 Units Homeworklib

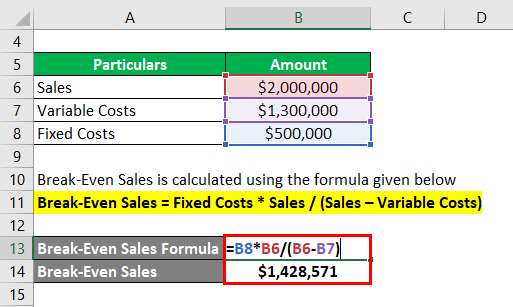

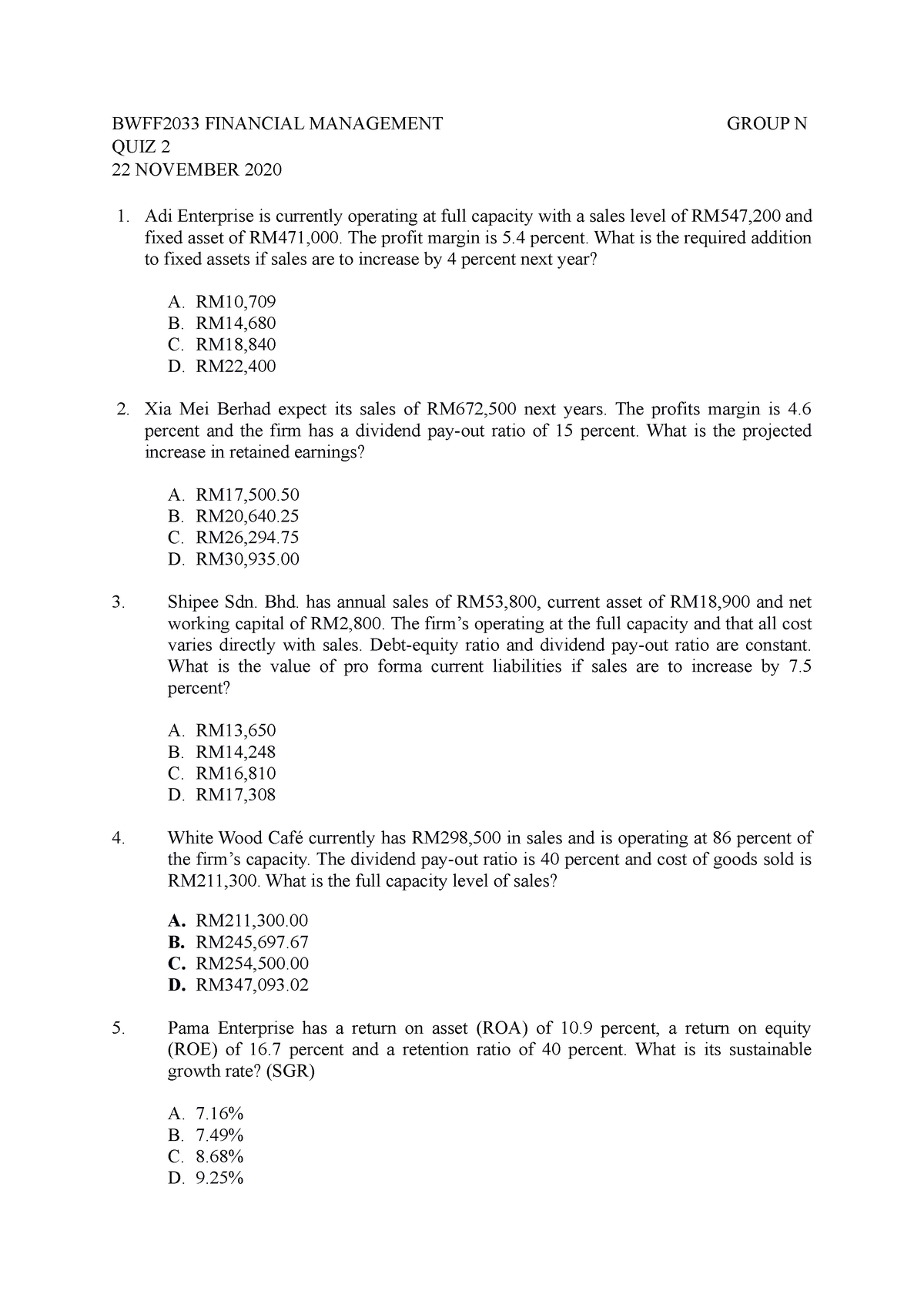

Basics of the BreakEven Point The breakeven point is the dollar amount (total sales dollars) or production level (total units produced) at which the company has recovered all variable and fixed costs In other words, no profit or loss occurs at breakeven because Total Cost = Total Revenue illustrates the components of the breakeven pointA $10,709 B $14,680 C $22,400 D $16,760 E $18,840 Robotics desires a146If a firm is at fullcapacity sales, it means the firm is at the maximum level of production possible without increasing A net working capital B cost of goods sold

Why Sales Capacity Matters Steve Rietberg

Thedocs Worldbank Org En Doc Render Worldbankgrouparchivesfolder Pdf

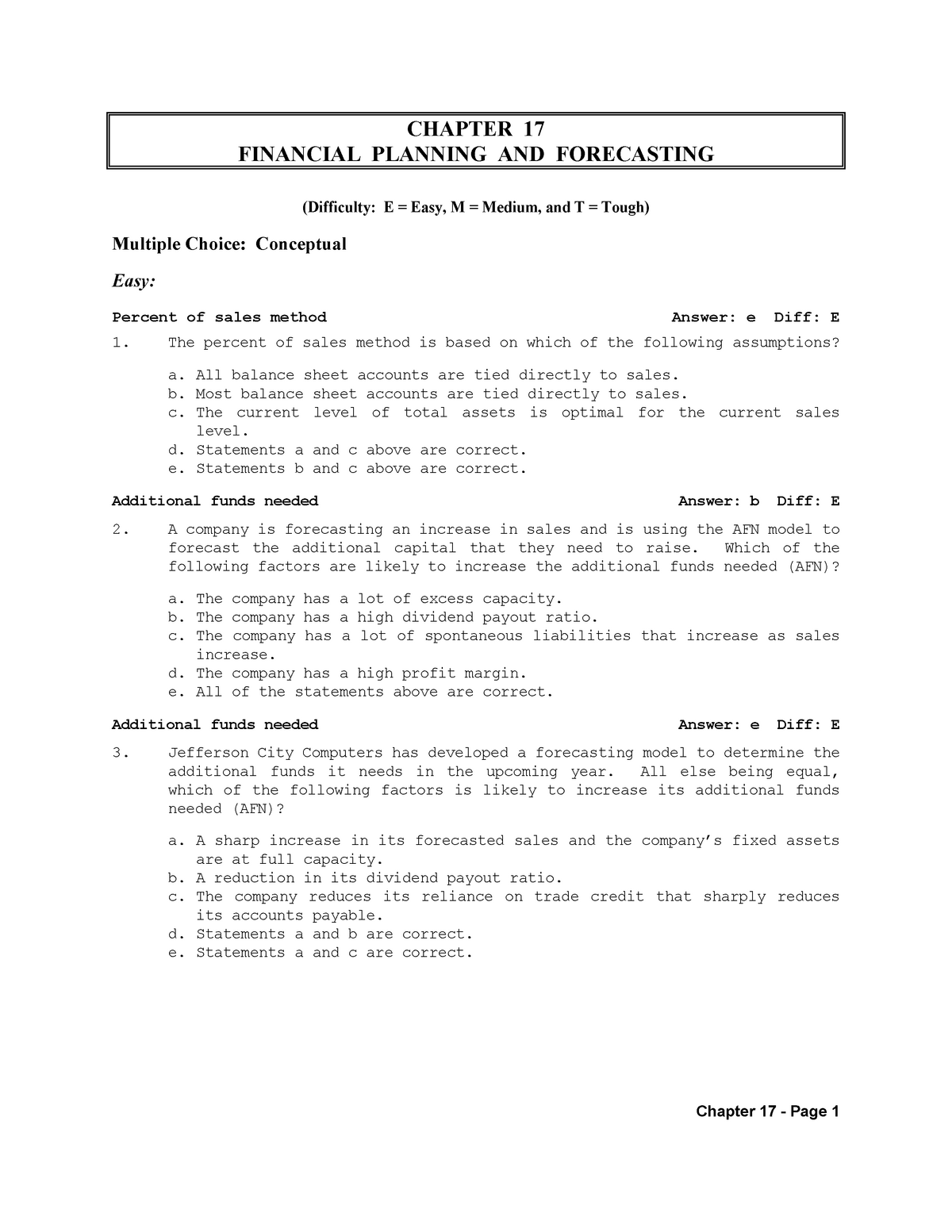

16 Assume the firm has a constant dividend payout ratio and a constant debtequity ratio What is the the maximum growth rate (Sustainable Growth Rate) the firm can achieve without any external equity financing?Additional funds needed (AFN) is a financial concept used when a business looks to expand its operations Since a business that seeks to increase its sales level will require more assets to meet that goal, some provision must be made to accommodate the change in assetsA $148,148 B $10,800 C $40,000 D $54,795 Capacity Level For Sales In the parlance of Finance, the sales

2

Godrej Appliances Plans To Reach Full Production Capacity From August Sales Already At Pre Covid Level The Economic Times

Full cost to make one unit of 'A10' = Rs 5 Rs 8 = Rs 13 The level of Sales at which both machines earn equal profits (c) The range of Sales at which one is more profitable than the other The present revenue from sales at 50% capacityExcess capacity Edney Manufacturing Company has $2 billion in sales and $08 billion in fixed assets Currently, the company's fixed assets are operating at 85% of capacity What level of sales could Edney have obtained if it had been operating at full capacity?Full Capacity BIBLIOGRAPHY Full capacity refers to the potential output that could be produced with installed equipment within a specified period of time Actual capacity output can vary within two limits (1) an upper limit that refers to the engineering capacity — that is, the level of output that could be produced when the installed equipment is used to its maximum time of operation

1

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

A lot goes into sales capacity planning — for a little more depth, take a look at this blog post — but here are the 3 major points to help you leverage sales capacity

The Impact On The Unit Cost Of Different Level Of Capacity Utilisation Download Scientific Diagram

2

Edgecore Newsletter February 21 Edgecore Networks

Long Term Financial Planning And Growth Ppt Video Online Download

Answered 12 Williamson Industries Has 7 Bartleby

Sales Commission Structures Everything You Need To Know Xactly

Capacity Planning 101 Building A Sales Plan

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Break Even Sales Formula Calculator Examples With Excel Template

Management Information System Mcq Pdf Document

Are You Calculating Your Sales Capacity Correctly Pivotal Advisors

Sales Capacity Planning Guide

Answered Break Even Sales Under Present And Bartleby

Information Sharing For Sales And Operations Planning Contextualized Solutions And Mechanisms Sciencedirect

Sales Capacity Kellblog

Break Even Sales Formula Calculator Examples With Excel Template

9901 1 A Days B Days C Days D Days E Days Pdf Free Download

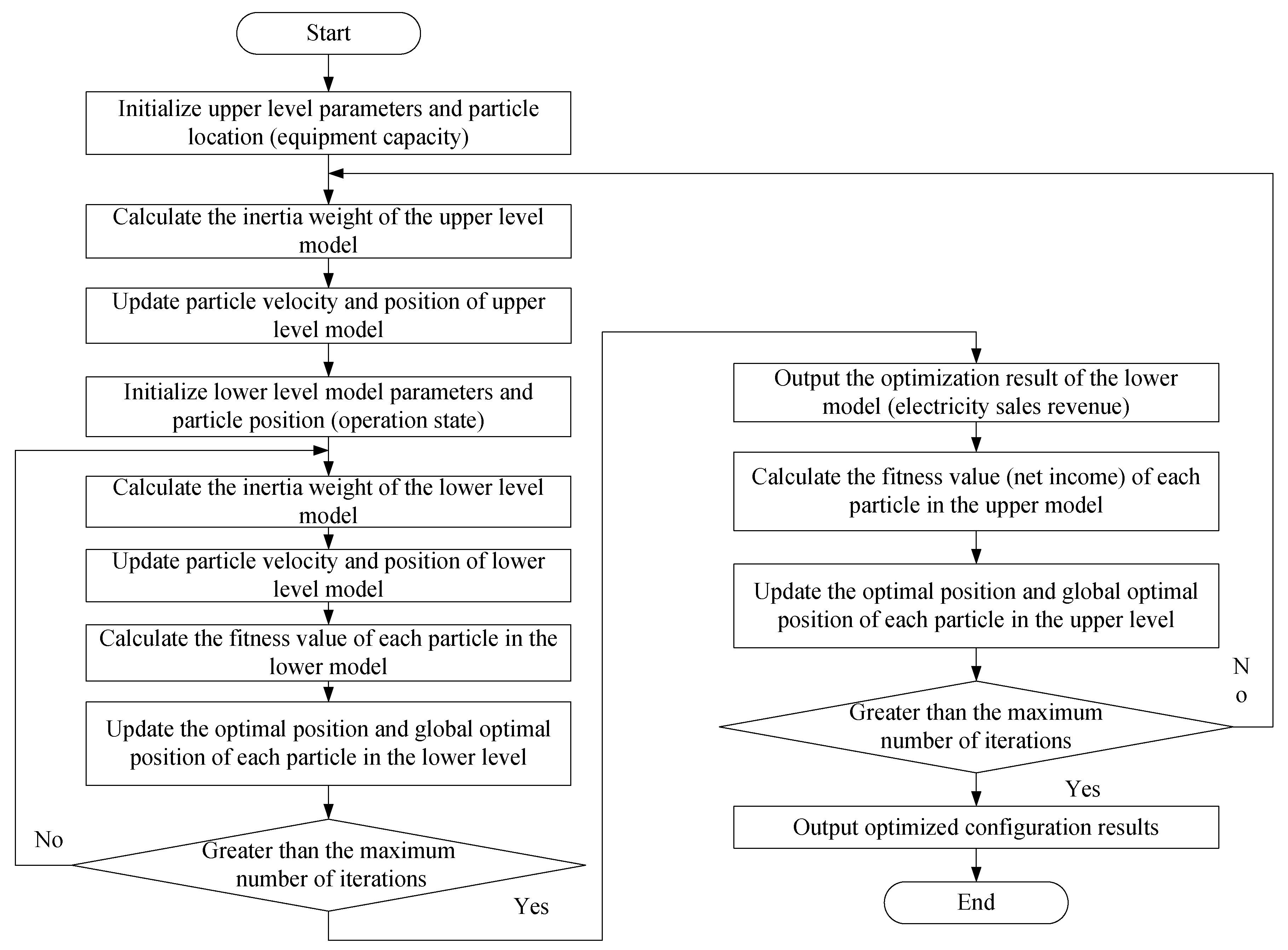

Energies Free Full Text Bi Level Capacity Planning Of Wind Pv Battery Hybrid Generation System Considering Return On Investment Html

Chapter 4 Question Docx 1 Fresno Salads Has Current Sales Of Rm6 000 And A Profit Margin Of 6 5 Percent The Firm Estimates That Sales Will Increase By Course Hero

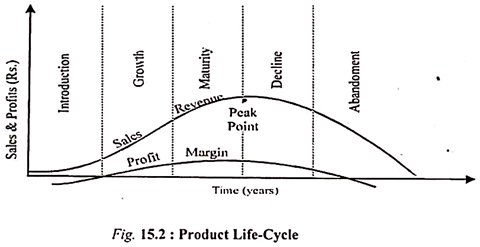

Product Life Cycle Stages 5 Stages With Diagram

1

Long Term Financial Planning And Growth Ch 4

Long Term Financial Planning And Growth Ch 4

Sales Assessment For Sales Team Capacity Score Selling Sales Training

Cefic Org Library Item Cefic Chemicals Trends Report January 19

6 Strategies For When Sales Hit Production Capacity

Full Capacity Sales Actual Sales Percentage Of Chegg Com

Renewable Auctions In Spain New Framework Mrc

Srd4j60r12

Determine The Amount Of Sale Units That Wpuld Be Necessary Under Break Even Sales Present And Proposed Homeworklib

2

Long Term Financial Planning And Growth Ch 4

Tutorial

Capacity Planning 101 Building A Sales Plan

Quiz 2 Quiz Studocu

2

Tb Chapter 17 Financial Planning And Forecasting Fin 303 Studocu

Matching Sales Capacity With Demand Gen Using A Bottoms Up Growth Model

Godrej Appliances Sales Reach Pre Coronavirus Level Expect Full Capacity Utilisation By September

Fukuda Ek 268g Instructions Pdf Download Manualslib

Plowback And Dividend Payout Ratios Your Company Has

Ch1 Introduction To Corporate Finance Pdf Free Download

Sales Capacity Planning Guide

Chapter 17 Projecting Cash Flow And Earnings Copyright

Perks Of Using Linkedin S Sales Navigator Internetova Agentura Sova Net

Financial Management Case Bsba01 Problem Pg 221 Afn Equation Refer To Problem What Additional Funds Would Be Needed If The Company Year End 15 Assets Had Studocu

Solved Darby Company Operating At Full Capacity Sold 72 900 Units At A Price Of 1 Per Unit During The Current Year Its Income Statement For T Course Hero

Covid 19 Is A Persistent Reallocation Shock Bfi

How To Increase Sales Team Capacity Openview Labs

Brand Messaging And B2b Marketing Testimonials For Daisy Mccarty

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By September Indiaretailing Com

Chapter 4 Longterm Financial Planning And Growth Mc

Right To Apply A Safeguard Part Ii The Challenge Of Safeguards In The Wto

Business Administration Basic Skills Guide Skat 1994 162 P Module 6 Financial Analysis Break Even Point Example Format

10 Jack S Currently Has 798 0 In Sales And Is Chegg Com

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

Williamson Industries Has 7 Billion In Sales And 1 944 Bill Quizlet

Sales Commission Structures Everything You Need To Know Xactly

12 2 Mitchell Manufacturing Company Has 1 100 000 000 In Sales And 370 000 000 In Fixed Assets Currently The Compan Homeworklib

Ppt Long Term Financial Planning And Growth Powerpoint Presentation Free Download Id

Sales Capacity Team Assessments Team Competency Summary Report Sales Skills Proficiency Level Disc Assessment

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

Jacquetmetals Information Related To The Impact Of Covid 19

Sales Capacity Planning Get The Most Out Of Your Sales Team Espatial

Doc Budgeting Staphord Kwanama Academia Edu

2

Sales Assessment For Sales Team Capacity Score Selling Sales Training

Sales Capacity Planning Get The Most Out Of Your Sales Team Espatial

Ppt Chapter Four Powerpoint Presentation Free Download Id

Sales Objectives Examples Pipedrive

Problem 3 19 Full Capacity Sales The Discussion Of Chegg Com

Corporate Finance Asia Global 1st Edition Ross Solutions Manual

Full Capacity

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Business

Comparing Two Ways To Build A Saas Sales Team

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Manufacturing Sales Cme

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Capacity Utilization Definition Example And Economic Significance

Long Term Financial Planning And Growth Ppt Download

Chapter 4 Longterm Financial Planning And Growth Mc

0 件のコメント:

コメントを投稿